Operating Leverage: What does this mean?

Learn all about Operating, Financial and Combined Leverage

You may have heard of Operating Leverage.

Or the fact that Operating Leverage is about to kick in ⚽

What kind of Leverage is this?

Is their more?

Find out all about Operating, Financial and Combined Leverage ⬇️

When you Google 'Leverage', it will give you this answer:

'the act of using a lever to lift or open something; the force needed to do this'

So whether you are Levering up your Balance Sheet (using debt) or letting Operating Leverage kick in (in your PnL) it's same.

So let's start with a PnL.

But we will not complicate it, we will make a very simple version of the PnL.

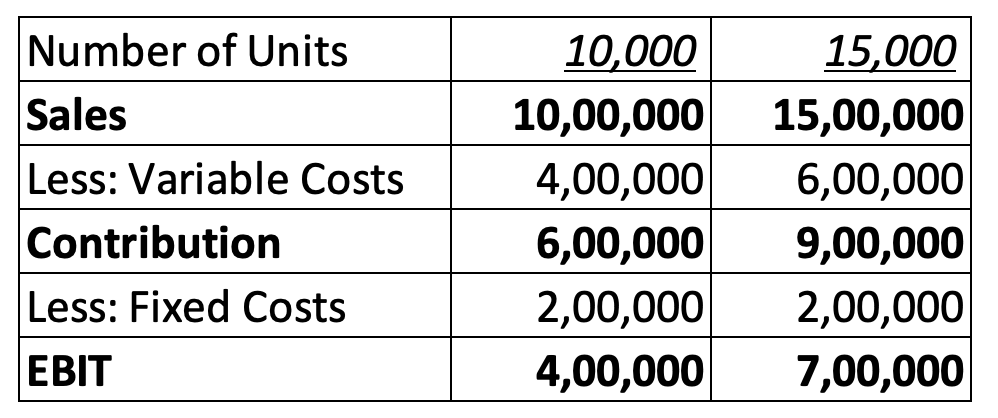

As you can see in the image below, we have Sales, Variable Costs & Fixed Costs to begin with.

More on the other items later.

So let's say you make a bottle of coke.

To make one bottle of coke you need 40 rupees - including sugar, water, soda, pet bottle etc.

You sell it for 100 rupees and you end up selling 10,000 units.

Your PnL will look something like this.

Now let's say you have a few fixed costs - factory rent, salaries, etc. that come to about 2 lakhs/year.

Expanding on the picture above, this is how the PnL will shape up.

Operating Leverage (OL) is defined as Contribution / EBIT which comes to 1.5 times in this case.

How does OL work?

For this, let's take another scenario.

Let's say you end up making 15,000 units i.e. Sales go up by 50%

The PnL will look like this.

So when Sales went up by 50%, EBIT or Operating Profit ended up going by 75%

That is what Operating Leverage does.

Or simply Change in Operating Profit was OL X Change in Sales i.e. 1.5 X 50% = 75%

Operating Leverage becomes more relevant in businesses where there is high capex involved - think hotels, airlines, paper companies etc.

In case you are interested in reading a deep dive on hotels, here’s a webinar explaining the nuances of the business:

(This link is accessible only to premium members. You can avail a 7-day all access pass to watch the entire library and unlock all paywalled content by clicking here.)

Now, it is difficult to dissect OL from the available numbers reported in a PnL, hence getting a core understanding of the business becomes important.

Speaking to people from the industry, management interviews and often simple common sense will give you a direction.

OL can also change let's say for eg if we add a small nuance to the case study. Let's say the factory has an outer capacity to produce 15,000 bottles.

Now to go above and beyond that, new capacity has to be added thereby increasing Fixed Costs and thus changing OL.

Takeaway: The way to look at OL would be to ideally see if cost structures remain fixed / the capacities are under utilised. If new capacity gets added, fixed costs again elevate, OL changes and then it takes time for OL to kick in back again.

Let's now come to Financial Leverage i.e. FL.

Let's assume the company has 10 lakhs of Debt and has to pay 1 Lakh in Interest Costs. The PnL will look something like this.

FL is calculated as EBIT / PBT which is 1.3 in this case.

Let's add the second scenario again where it ends up making 15,000 units. The new PnL looks something like this.

So with a FL of 1.3, a 75% change in EBIT translates to 1.3 X 75% i.e. 100% change in PBT.

Just like OL is a moving picture, even FL behaves in a similar way.

Let's say you end up reducing Debt and your interest cost falls dramatically, your flow through to PBT will shoot up massively.

On the contrary, even if you have massive OL & your debt goes up, converse happens.

Takeaway: Look at the debt position of the company, whether it is comfortable servicing the interest cost and are there any triggers for it to go down drastically or go up. While the former happens, it is fine but the latter can cause challenges.

🎁 Bonus Content

If you would like to see a short summary of the concepts covered above, here's a link explaining the various facets of Operating Leverage from a deep dive done last year.

So, what was your key takeaway? Let me know about this in the comments below.