By this time, you must have read about 25,000 articles and posts on the fact that a bank called Silicon Valley Bank (SVB) exists - sorry, used to exist and as of now has shut shop.

Can this happen to any bank in the world?

Can they just, shut shop, overnight?

Yes!

Aren’t they risky?

Yes!

Then why do investors invest in banking stocks?

Ok, let’s come to the basics.

Let’s try and understand a very basic tenet of Banking.

Banking lives, breathes, eats & THRIVES on Leverage.

Let’s say you and I start a bank.

We put INR 100 from our pocket.

Now we need more money to lend further - so we go and raise more capital in the form of Debt. We go and raise INR 500 in Debt at 9%

[Now think of this Debt as a mix of money taken from the public (fixed deposits), raised in money markets (short term and long term debt)]

Now we have a total pool of INR 600 as capital to play with.

This is how the Liability side of our bank will look like.

Now can we lend the entire 600?

Not really - we need to have some buffers - In the Indian context it’s called SLR (Statutory Liquidity Ratio), CRR (Cash Reserve Ratio) - some part gets parked with RBI, some with Grade A securities (Govt. Bonds etc.) that need not necessarily carry a lot of volatility - to prevent any catastrophic event.

Even if we remove the element of buffers, let’s say you lend the entire 600 (for ease of understanding)

This basically means just a write off of 100 rupees can make you bankrupt!

Wait what?

You see, on the liability side 100 is self funded - the core equity that you put in the business.

500 is external debt.

So if you have a loan book of 600 and if 100 goes bad for any reason - it has literally wiped out your equity - looking at a potential bankruptcy.

Now, let’s look at another scenario where for some reason you think that I don’t see a lot of loan opportunities available.

So instead of giving out money as loans, you invest / park it in some instruments and wait for a better opportunity.

If you go back, our Cost of Debt was assumed at 9%

Now, I have a choice - either I optimise returns on the asset side - try and invest in assets where I make more than 9% (but this also increases my risk)

Or prioritise risk management with a negative cost of carry (park money in assets where I make less than 9% but ensure this gets called when needed)

So coming back to our Bank, a potential Asset side looks something like this:

Now, in an ideal scenario, this is how a typical banking Balance Sheet looks like.

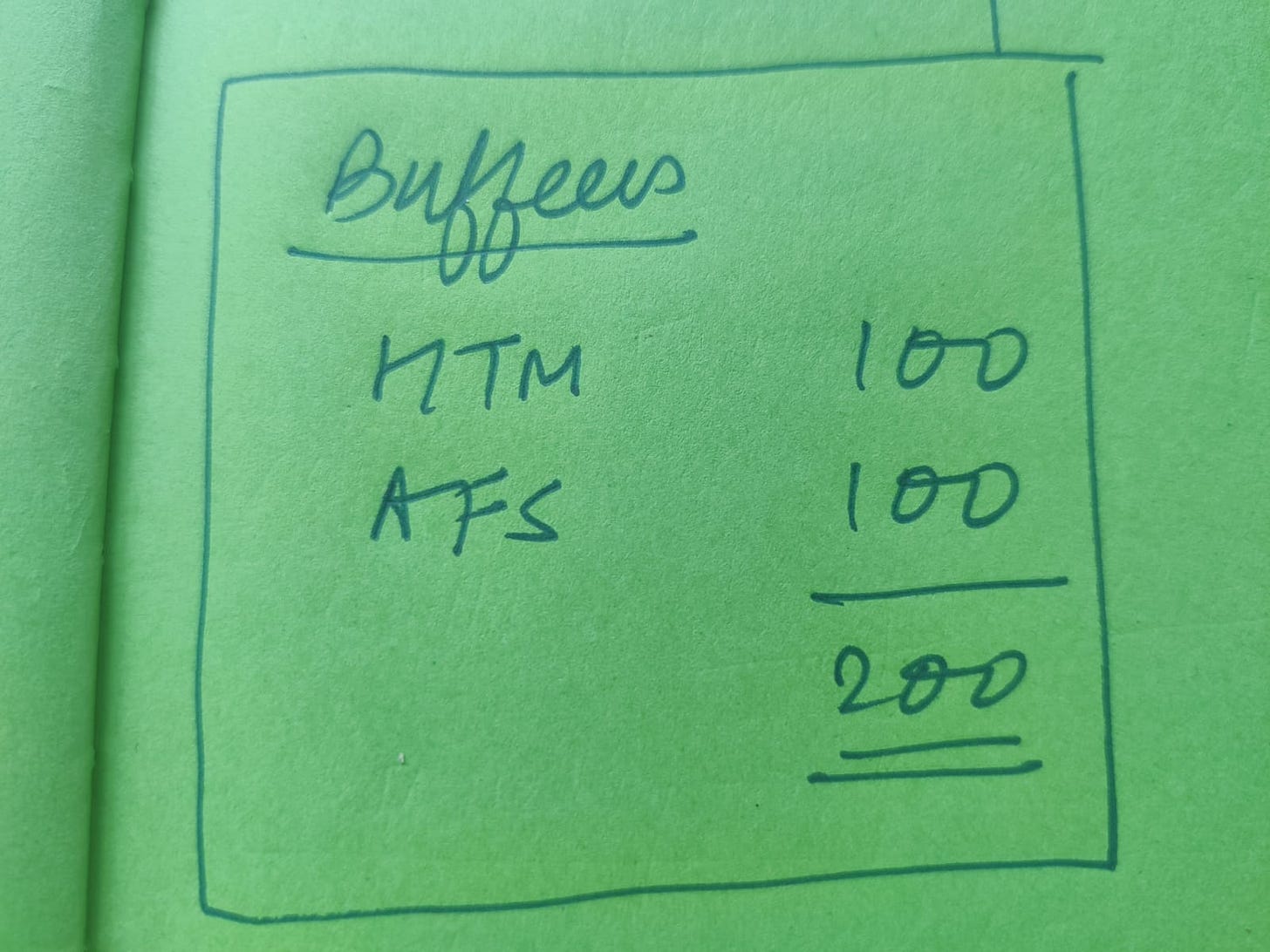

Let’s break down buffers - these are typically parked in Investments which are classified in two buckets -

Available for Sale (AFS)

Held Till Maturity (HTM)

AFS as the name suggests is more liquid, can be bought and sold freely and whatever gains / losses arise need to be reported in the PnL

On the other hand HTM as the name suggests needs to be Held Till Maturity - you lock in a return today with a particular maturity - say 5 years, 10 years 20 years and hold the instruments till maturity

So, this is how buffers would look like:

Let’s say you held a HTM instrument that would give you 5% for a 10 year period.

The interest rate moves and today depositors in your bank that had parked savings at 6% are getting 9% in today’s terms.

They will think they have got themselves into a bad deal and swarm to your bank to liquidate their deposits.

Now you will use your AFS buffer and liquidate - get about 100 to arrest this inflow of deposit redemption requests.

Only now, instead of deposit holders, your bond holders also come to you for getting their money back.

You now need to dip into HTM securities - something that may be valued at 80 or 70 or even 60.

Why?

These were long dated instruments - and due to short term fluctuations in interest rate, their value will fluctuate - but you are strapped for cash.

Because remember,

Banking lives, breathes, eats & THRIVES on Leverage.

Now before we dive into what went down at SVB, another small characteristic is important:

If my HTM portfolio goes from 100 to 20, I just need to report it as a footnote and not take a hit on my PnL - whereas all the movement in AFS needs to be marked to market and recognised in PnL.

Now for someone to sell HTM before maturity, it needs to be classified to AFS with the change in asset value movement recognised upfront in PnL -

In the Indian context, regulatory oversight by RBI prevents catastrophic tail events from increasing risk in the system:

RBI has ensured all profit on sale of Investments are transferred to IFR till 2% of HFT / HTM + AFS is met. This acts as a cushion to ensure any rise in G-Sec Yields are absorbed.

This is from the RBI Financial Stability Report.

Now, let’s delve into what SVB was upto:

Let’s look at three basic parameters:

The equity in the bank was USD 11.5 bn

Rise in deposits between 2019 and 2021

What did the bank do on the asset side?

Between 2019 and 2021, the deposits in SVB grew from USD 61 bn to USD 189 bn

These came in at an average cost of 25 bps i.e. 0.25%

So an extra USD 128 bn came on the Liability side at a cost of 0.25%

What did they do with this?

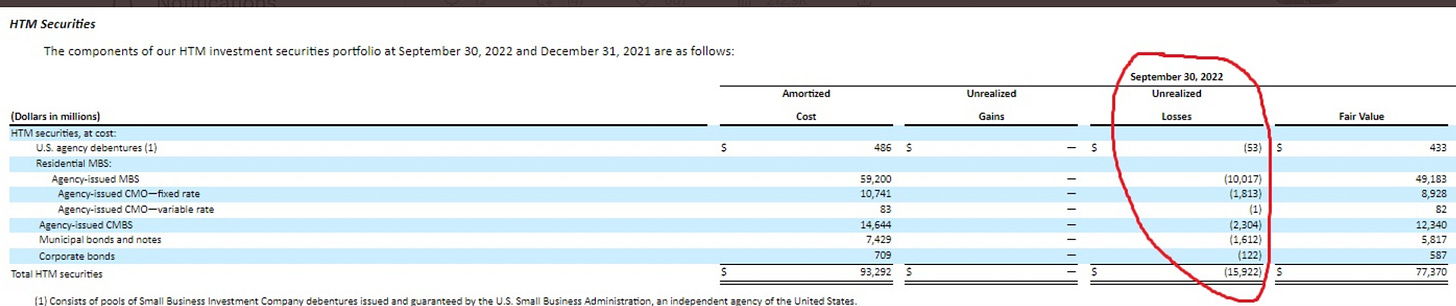

USD 33 bn was given out as loans and ~ USD 86 bn of buying happened in MBS on the HTM portfolio (10+ year maturity with a yield of 1.63%)

All good till here, right?

Now, depositors suddenly discover interest rates on deposits are 3-4% thanks to Powell hiking interest rates - so they have got into a bad deal, right?

They come asking for money from the bank.

Only here, loans that are given to start-ups that are burning cash left right and centre are probably not paying back anytime soon.

Ok, so where do you tap in?

The HTM portfolio of MBS?

What has happened to the yield in that?

An unrealised loss of USD 16 bn!

Remember what we discussed above, for this to be liquidated - you need to reclassify HTM to AFS and take this hit on your PnL upfront.

Now also remember point 1 for SVB - their Equity is USD 11.5 bn

So, you are looking at potential bankruptcy!

Herein comes 3 questions to my mind:

1 - What was the risk management team upto?

2 - Why was all incremental HTM investments locked in 10 year MBS with NO HEDGE!

(Typically ‘Buffers’ need to ensure they are well, buffers - so if you are locking in 10 year interest rates, there is a high chance that yields could move in the short term. So as a hedge i.e. to protect against adversity, you do an interest rate swap, a hedging mechanism where if the rates move significantly, your HTM losses can be compensated by money made on swaps - which for a bank parking USD 88 bn incrementally was not just important but well, essential.)

3 - Did the treasury team of the bank not see this as a bear case scenario?

So, the question arises - what now?

There will be Fed Intervention - As of the time I am publishing this, an emergency meeting has been called for on 13th March, 2023 to discuss next steps on how to address this mess

Leverage thrills, but when it kills - it cuts deep: Systemic failures have always occurred on leverage going wrong, it always has a multiplier effect. You save 100 rupees, you put it in a bank, bank lends 100 to a company, company pays a salary to its employees, employees save, put it in a bank and the cycle continues. When someone in the chain defaults - the ramification can be 8-10x of the initial value. So, while systemic failure is a possibility, the regulators will ensure it does not end up spreading far and wide.

Does India get affected? - A lot of startup funding in India comes from the west. Secondly, a lot of the money raised if often parked in foreign banks - so that can see a squeeze in the short term.

Are our banks safe? - The RBI has been at the forefront of regulating our banking system to avoid any sort of systemic failure. Constant oversight along with ensuring innovation continues to occur is something that has kept us sane and solid. All of this ensures that ‘tail-event’ risk is minimised and the system runs smoothly.

Many people are touting it to be one of the biggest banking failure to hit us. After 2008, we would have thought things like this would not get repeated but a common trait ties all of these notorious events - Greed at the cost of ignoring basic risk management.

Have something to add? Let me know in the comments below.

Very well explained Saket, thank you!