Supply side Dominance is creating exponential value

It is no longer about Demand in aviation

Almost 2 years ago, I had started researching on Indigo. If you have been reading this blog since I started, almost 5 years back I had written a forensic piece on Spicejet which was appreciated globally on the thought process it brought out.

Today, as aviation in this country keeps growing at break neck speed, I thought this would be an opportune time to publish a thesis I wrote on Indigo for myself internally about a year ago.

This was shared internally to a few subscribers last month when the access was requested. Since I have been getting multiple requests, decided to give access to all via a post. You’re welcome :)

Special Access

This was written sometime in last July.

Before you dive deeper, I am making a small revelation about this week’s webinar. Interglobe is a part of the deep dive we are going to do and has also been covered in the post about Cash Flow changes in the post Ind-AS world that makes its Profit and Loss Statement not look the same.

India currently has about ~600 planes out of the global total of 24,000 and is one of the fastest-growing aviation markets in the world. Historically, the sector has been avoided due to the very high mortality rate of companies operating in this space.

What if there was a company that is cash-rich, operates a no-nonsense airline, and is well-placed to capitalize on the burgeoning Indian aviation market? Enter: Interglobe Aviation (Indigo).India has collectively placed orders for ~1,800+ planes to be delivered over the next 10 years. Indigo will receive ~1,000 of them.

Globally, Boeing and Airbus (the two major airline manufacturers) can only deliver 1,000 planes per year combined. They have a combined backlog of 13,000 aircraft. As a result, no new player can enter and meaningfully increase supply.

Indigo holds 32,000 cr. cash on the Balance Sheet (12,000 cr. is restricted cash, e.g., security deposits, statutory advances). It always leases planes to keep the Balance Sheet asset-light. The process involves placing orders with Airbus, selling to AerCap (a global airline leasing company), and leasing back.

Upfront on every Sale & Leaseback, Indigo gets cash to procure ATF supplies, pay for parking, and other dues. It runs advance ticket sales of 1 month, technically making the cost of starting a new plane 0.

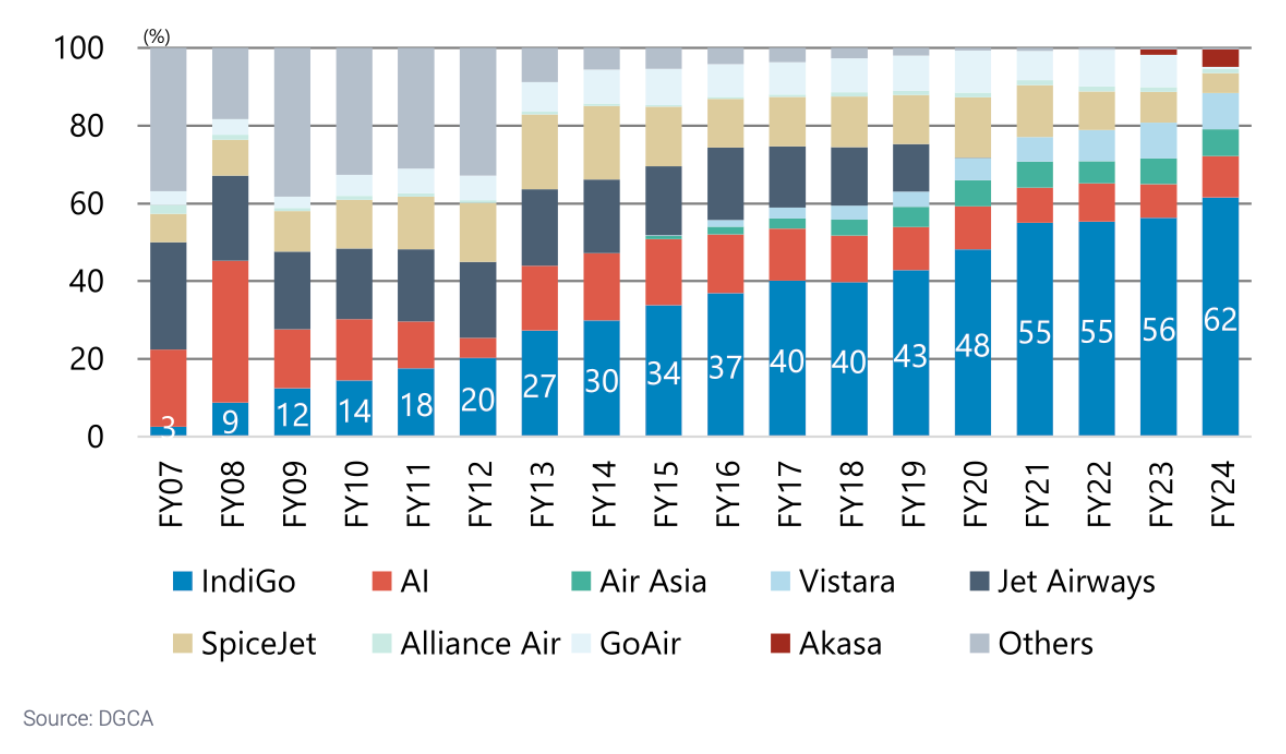

With 62% market share, Indigo is the airline of choice for travelers flying anywhere within the country. A smart aspect of Indigo's fleet is that the same aircraft can fly domestic and international routes. The current fleet (A321 Neos) has a range of 6,500 km and 6 hours. The new fleet (A321XLRs) has a range of 8,500 km and 8 hours, with bigger seat capacity.

Along with increasing fleet count, Indigo will increase ASK (Available Seat Kilometre) at a higher rate due to better range and more seats.

Now let's look at the cost side. ~40% of sales ends up in Fuel Cost. Currently ATF prices are towards the upper end of historical average prices.

We are also looking at a possibility of fuel costs coming down further improving the profitability and the bottomline of the airline.

At the current juncture, we are getting India's best airline (and probably one of the world's best airline) with 62% market share, having survived in the intensively competitive space in the last 15 years with 32,000 cr. cash on books. The business generates a Free Cash of ~15,000 cr. a year. We are getting this business at 6x FCF (ex-cash).

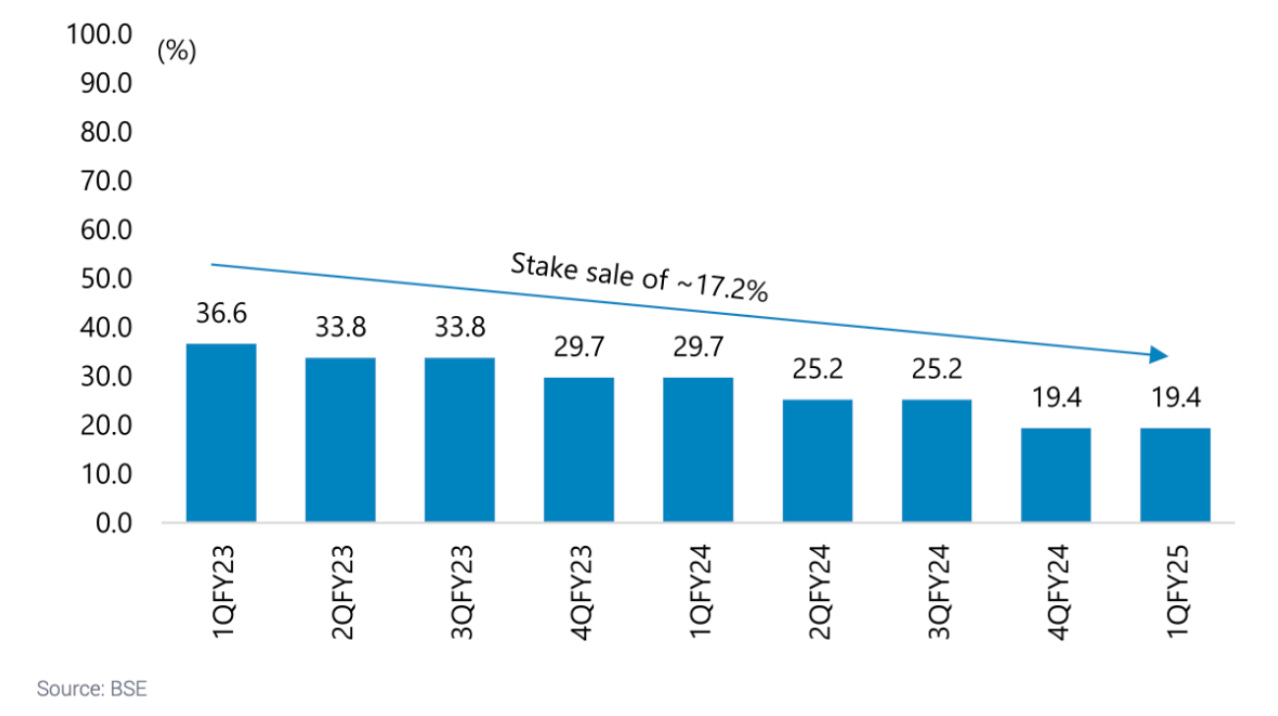

The market has been choppy about Mr. Gangwal (the non-active promoter) selling stake in the company.

Until recently, Gangwal sold another 4% reducing his stake further to 15%. However, the important thing to note here is that all his stake sale has been happening at a price higher than his previous sale. Legally, there is a 150 day lock in between two stake sales, but despite that, we have not seen any major price correction given the gigantic size of share sale happening in the counter.

On the other hand, we see a variety of near term triggers for the airline –

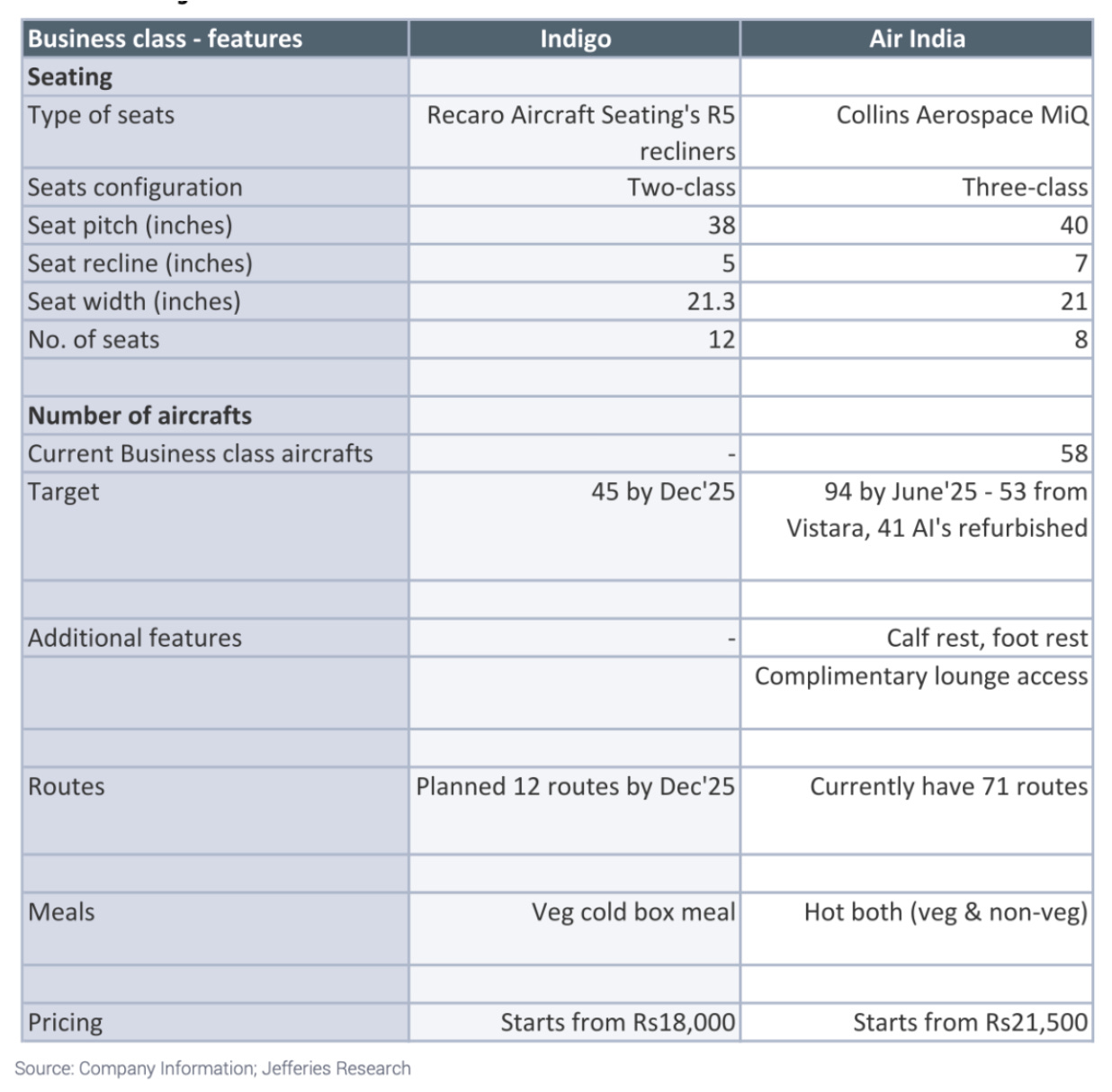

1- Introduction of Business class, which is going to be revenue accretive for the Company

2- Introduction of Loyalty Program – Indigo BluChip to push on customer consistency and loyalty, which has been absent since the inception of the airline

3- Integration of hotel bookings on the website which can generate additional revenue for the Company (currently not very material but over time we can see how it evolves)

4- Indigo’s relentless focus on expanding international routes – currently has 18%market share in the international routes to and from India. Starts with doing codeshare agreements with major airlines and over time introduces their ownplanes to maximize bottomline

Indigo has gained market share in 17 out of 18 years since it has existed.

It has 80% mix of New Gen Aircrafts thanks to its clever sourcing policy of Sale and Leaseback minimizing the impact of maintenance cost and also keeping operationally one of the best in terms of on-time performance amongst the top 10 airlines globally.

Now, I know what you are thinking - All of this is great. What now?

Well, why my thesis initially on Indigo was on Free Cash Flow and not on EBITDAR / PAT was because of something I wrote a while back.

Cash Flow: The Untold Truth Behind Profit

PSA: Today’s post is a little longer than usual, you may have to open it in a browser in case you are reading it on e-mail

So, how does the current math stack up for Indigo?

Market Cap - 232,000 cr.

Cash on Books - 49,400 cr.

Free Cash - 34,800 cr.

Let’s say Indigo ends up doing about 16-17k cr. Free Cash in FY27. This is consensus brokerage estimates. We are getting this company at 2 year forward 12x multiple.

Growth Titans of Q1FY26 | Webinar #001

Last evening I provided a glimpse into what to expect in this week’s webinar. Can’t believe the quarter has come down to the month and now to this week!

There are only 5 Days to go. We shall shut all registrations by Friday.

Countless hours, distilled insights.

See you in the Live Webinar. Click below to register ⬇️

Disclaimer: Neither Saket Mehrotra nor Beta to Alpha is a SEBI registered investment advisor. Views are my own and do not represent my previous or current employer. Any mention of stocks and securities is not a recommendation to buy / sell. The author may hold positions in the stocks mentioned and sell it without prior notice. Please do your own due diligence before investing. The purpose of this newsletter is for educational purposes only.