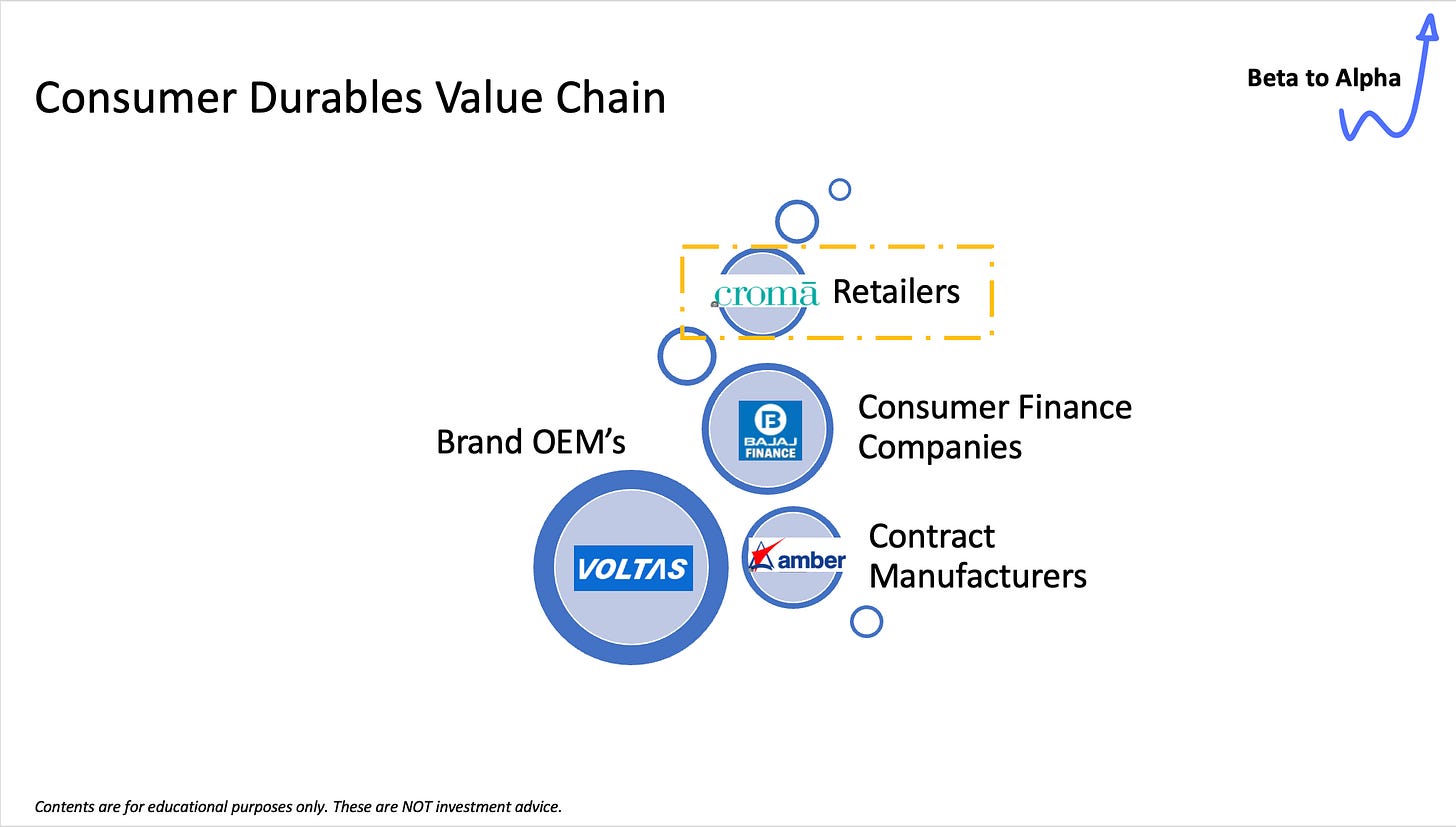

When people think of the consumer durables value chain, they often focus narrowly on brand owners, contract manufacturers, or consumer finance companies. But there’s so much more to the story.

Let’s break it down with a real-world example: Voltas, a well-known brand owner that manufactures air conditioners. Behind the scenes, companies like Amber step in as contract manufacturers, producing AC units for Voltas.

Then, when you walk into a retail store, it’s often an executive from Bajaj Finance or similar firms nudging you toward an upsell with attractive financing options.

This trio—brand owners, contract manufacturers, and finance companies—is just the tip of the iceberg.

The Missing Link: Retailers

What’s often overlooked? Retailers. Where do you shop for that Voltas AC? It could be a Croma, Reliance Digital, Vijay Sales, or a local retailer with a strong regional foothold. These players are the bridge between production and the end consumer, playing a crucial role in driving demand. Without them, the value chain would stall.

The Impact of Changing Seasons

This quarter, early monsoons and a shorter summer took a toll, AC sales dipped, and beverage sales didn’t scale as expected. But India’s tropical climate isn’t going anywhere. As time progresses, summers will get hotter, and winters warmer, ensuring a steady rise in demand for cooling solutions and other durables. This long-term trend outweighs short-term seasonal blips.

Decoding Demand: Sales, Inventory, and Production

So, how do you gauge where demand is headed? From a growth perspective, it’s a cycle: sales → inventory → production. Strong sales at Croma signal confidence for Voltas to ramp up production and place larger orders with Amber.

Flip the lens to the value chain view—production → inventory → sales—and it works in reverse. If Amber’s order book swells due to Voltas anticipating a demand surge, it could eventually translate into higher sales at retail outlets like Croma.

The Bigger Picture

The consumer durables ecosystem is a complex web of moving parts. It’s not just about the brand owner (Voltas), the contract manufacturer (Amber), or the finance company (Bajaj Finance). Retailers provide a vital pulse on end demand, and today’s consumers have more options than ever, e-commerce, brand websites, and even quick commerce. While we lack a large listed proxy to track this retail segment comprehensively, regional players offer valuable insights into demand trends.

Next time you think of consumer durables, look beyond the obvious. The interplay of production, financing, and retail, amplified by India’s evolving climate and consumer behaviour, paints a dynamic picture of growth. Keep an eye on all these pieces; they’re what drive the industry forward.

This week I concluded two live sessions - finishing hosting the Real Estate Value Chain Webinar. When asked - what should I cover next, 86% of the respondents want a breakdown of the AI & Data Centres Value Chain. So next month I will host a deep dive on that.

In case you wish to access past recordings, you can access them below:

Last month, we did a detailed deep dive on covering Companies that are inflecting on Growth. It was also the first webinar of the 2025 Beta to Alpha series.