What We Underlined, Unfolded

The Quiet Signal, Loud Outcome: Thoughts on the recent IPO listing's Q2 results and what is in store for Sai Silks Kalamandir, a company that came through in Growth Titans of Q1

Two weeks ago, we did a detailed deep dive into an IPO that was about to list the next day - Canara Robeco AMC (CRAMC).

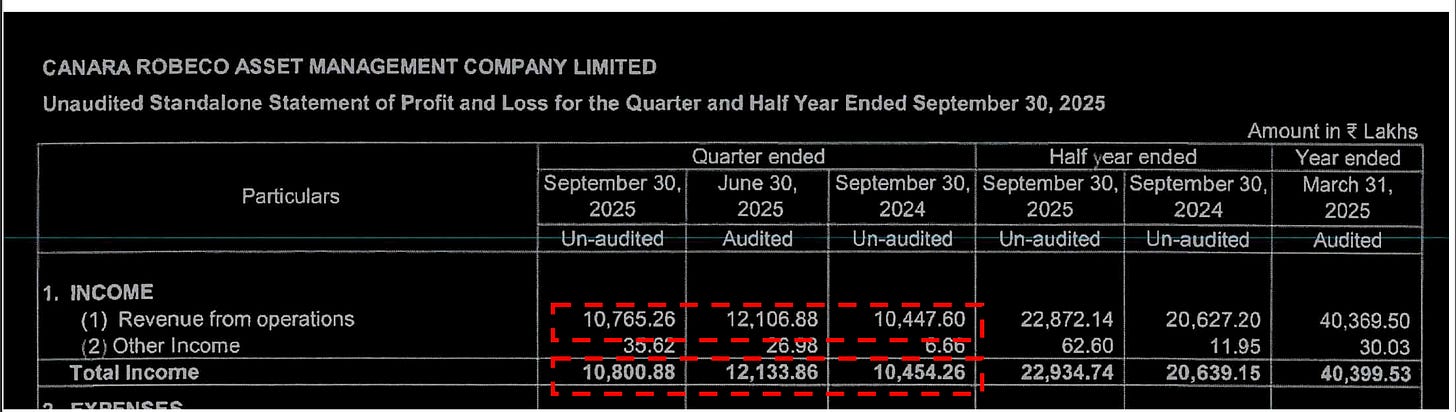

Today, they announced their Q2 results, and on the face of it, it does look like there is no growth.

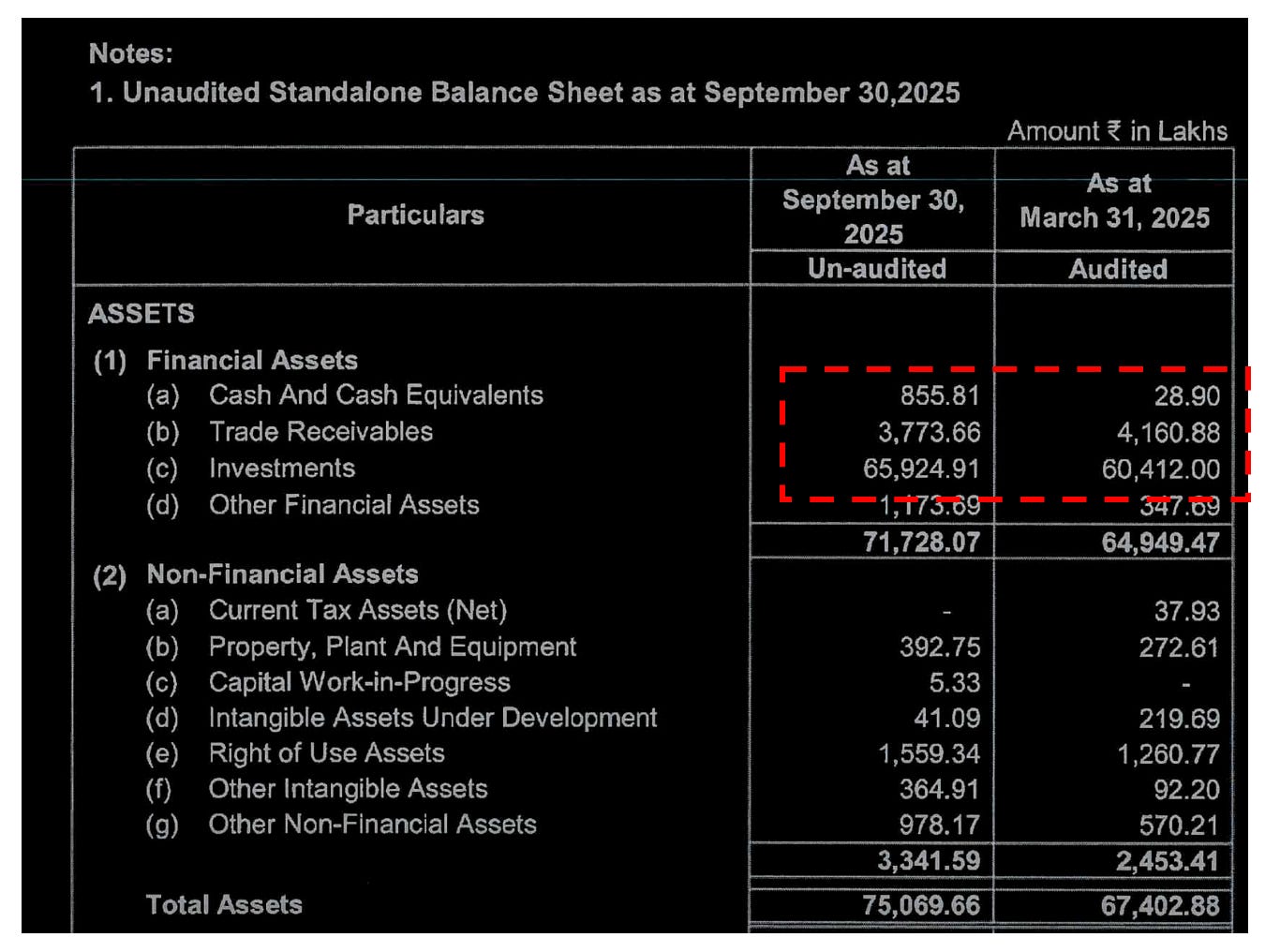

Interestingly, most AMCs have a lot of cash and investments in their Balance Sheet. CRAMC manages about 1L+ cr. in AUM - so naturally they should also be having this. Let’s see what’s happening there.

So almost 670 cr. of cash and investments.

The total Balance Sheet size is ~717 cr.

Even if you assume a 5% modest yield on this, that translates to about 30-34 cr. a year i.e. 8 cr. a quarter. Then why does the Other Income above look abysmally low?

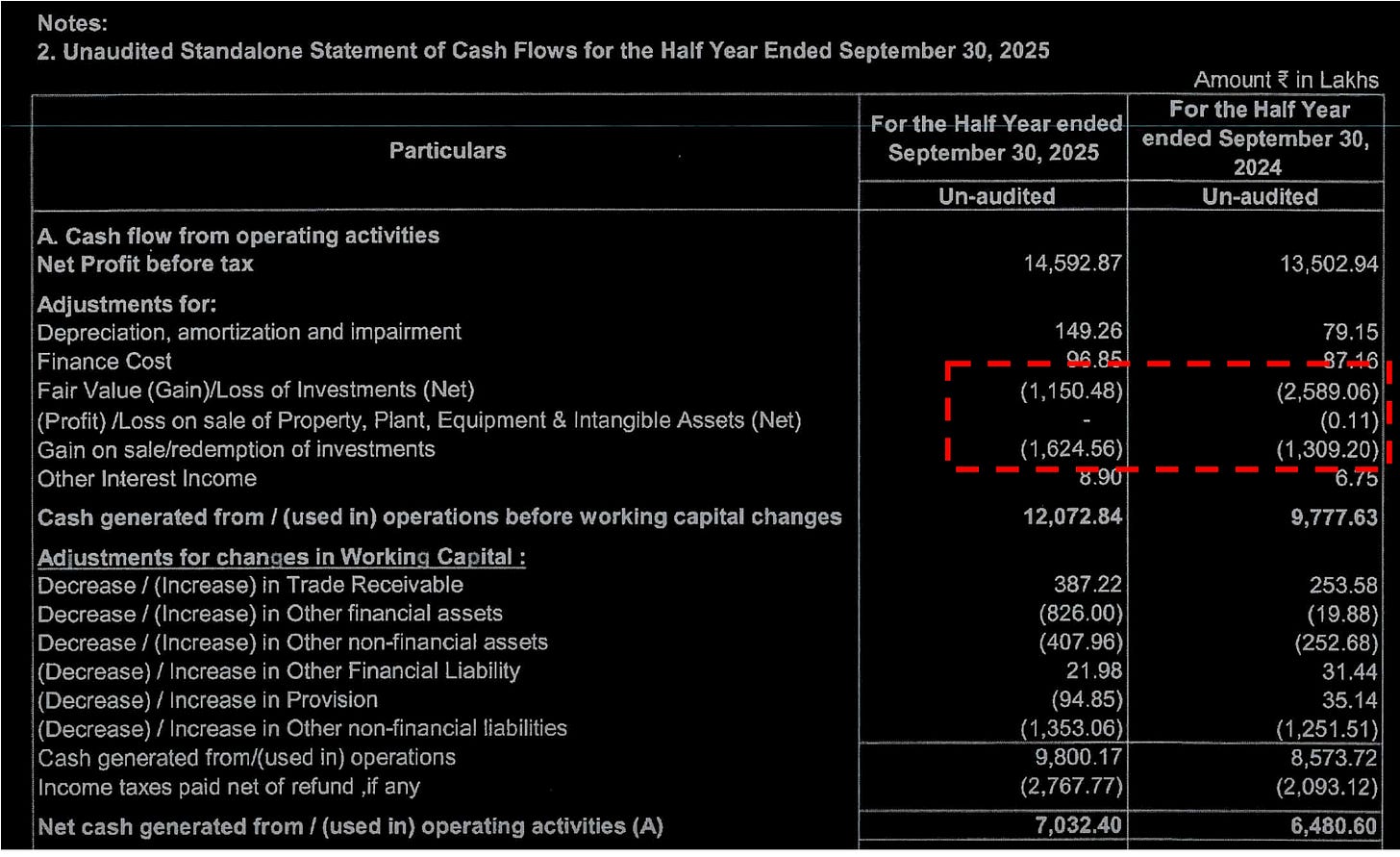

Let’s try piecing this through by looking at its Cash Flow Statement.

As you can see for the 6m ending Sep ‘25, the MTM and treasury income was about 28 cr. This number was about 39 cr. in the last year in the same period.

Going into IPO, the Q1 Treasury and MTM income was about 24 cr. This was ~21 cr. in the same period last year. (sourced through various IPO notes for CRAMC)

This means that the other income for Q2 was about 4 cr. (28-24)

For the same period last year, this number comes to 18 cr. (39-21)

Now excluding the impact of these, let’s see how CRAMC has fared.

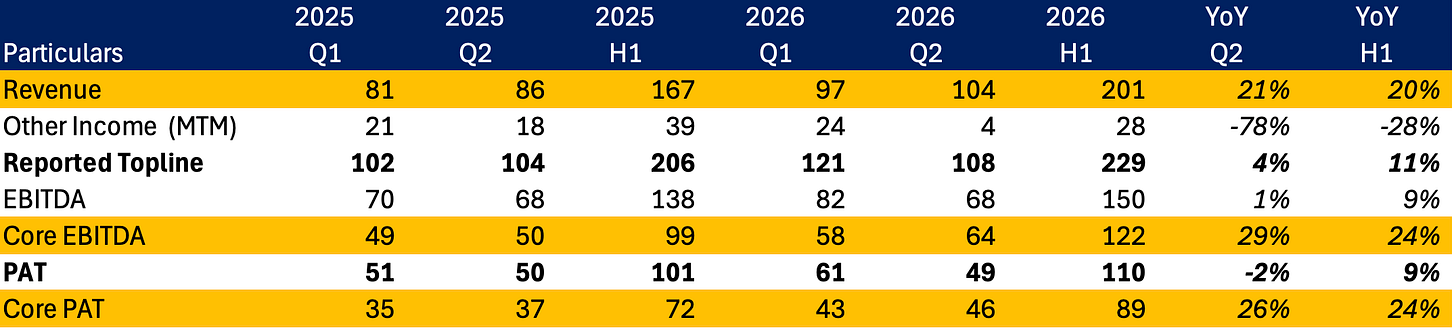

So, in reality, the Revenue growth is actually 21% which puts it on the highest growth number amongst all listed AMCs.

Now, we do not know how Mr. Market is going to react on the headline earnings of 4% Topline growth and 2% PAT decline.

But the core numbers (excluding the impact of Treasury and MTM gains) show us a robust picture.

We discussed about why looking at cash flow statements is important here.

Sai Silks Kalamandir - Strong Execution with Operating Leverage

We had discussed about this company in The Growth Titans of Q1 webinar. As a follow up to that, we had also spotlighted when the Q2 business update came through.

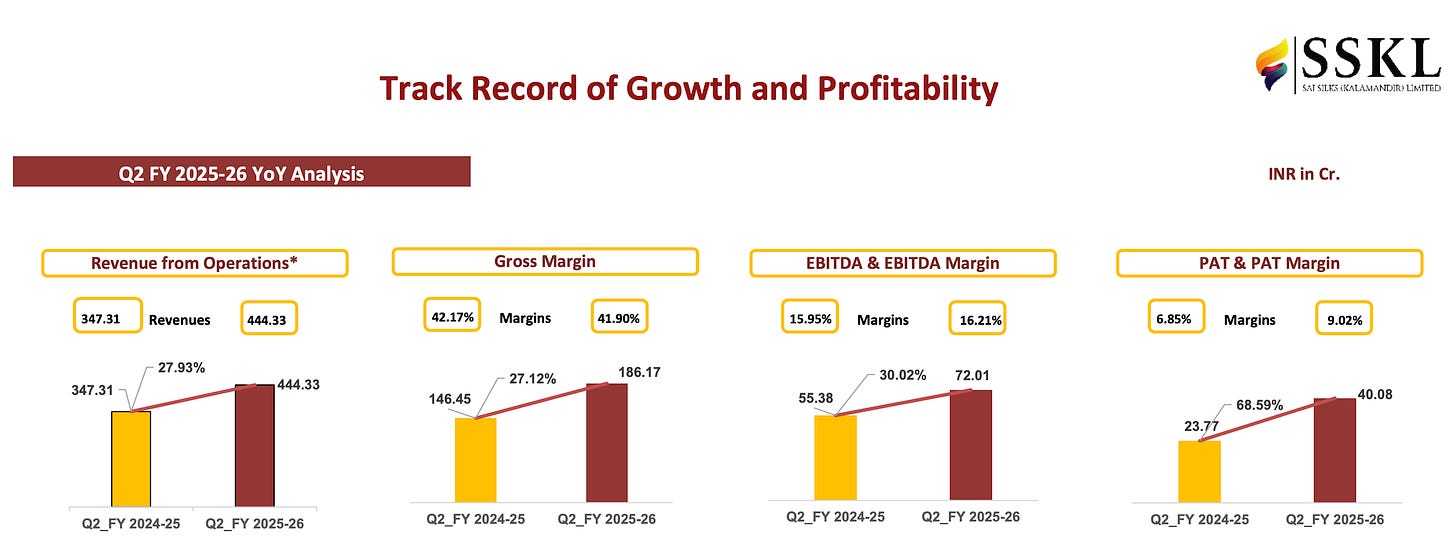

The interesting part about their Q2 results was it was not just growth on the topline, but all round flow through to EBITDA and PAT.

Earnings season have just started, and this time we are prepared to host a bigger, better and a bolder version of the Growth Titans of Q2.

The webinar will be hosted live in the last weekend of November - do not miss registering for this one. In case you did not attend the first webinar, we have a bundled access option enabled for you.

The headline numbers do look flat, but that’s more a function of muted treasury and MTM income rather than weakness in the core business. The underlying revenue growth of 21% actually puts CRAMC among the top performers in the AMC space.

That said, the low other income does raise questions — either on deployment mix or on timing of investment recognition. If this persists into Q3 despite stable yields, then it might point to a structural change in how they’re managing treasury.

So yes, the market may initially react to the 2% PAT dip, but the core profitability and operating leverage story still seems intact. The next quarter’s commentary on yield and AUM growth will be crucial.

Well written wrt Canara Robeco - Didn't notice the other inc part for last Y. Makes sense now.

IPO'ed @ reasonable valuations unlike ur Lenskart (200+PE) - Can re rate if the Market also starts to move up as they have Majority Eq AUM.

Signs of reversal on charts intraday too coz ppl realized the valuations and other income thnx to ur post.